Retail Expansion into USA

The story of brick-and-mortar retail’s demise has been a popular narrative both far and wide. The recent spate of nationwide store closings and bankruptcies from well-established brands have caused some alarm amongst retailers. In New York City specifically, high retail rents have priced out many businesses as landlords demand top dollar. In turn, vacancy rates have steadily climbed over the past 24 months to levels approaching those seen at the height of the Great Recession.

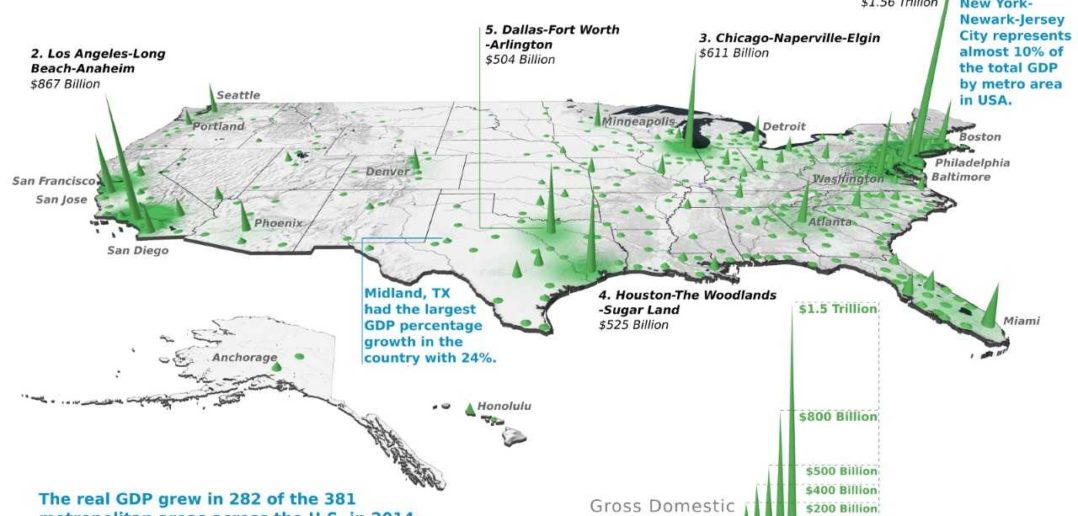

However, the economy of New York City today is much different from that in 2008, or even at the height of the retail boom in 2014 – in fact, it is more robust than ever. The Gross City Product (GCP) of New York is $1.5 T, second only to Tokyo amongst cities, and would rank amongst the top 20 countries in economic output – placing it just behind the Canada ($1.6T). Moreover, the city’s growth rate continues to outpace other major industrialized European cities, and the United States as a whole. New York’s GCP has grown at a rate of 2.3% in Q1 and Q2 of 2017, while the U.S. GDP has grown at a rate of 0.7% during the same time. New York is also adding over 33,000 jobs (3.1%) per quarter in 2017. And its unemployment rate of 4.3% is the lowest ever recorded for the city. In a time where wage stagnation is a major concern for the United States and other industrialized economies, New York’s personal income rose 9% year-over-year from 2016.

With that knowledge in hand, it can be inferred that climbing vacancy rates and ensuing rent reductions in the retail sector are not signs of an economic downturn, but market course-correction – one that can be seen as an unprecedented opportunity for foreign retailers to break into the New York market at deeply-discounted rental rates and abundant landlord concessions.

New York City has always been an entry point for global brands looking to appeal to not only an American consumer base but also an international one, thanks to the booming tourism business and the uniquely multicultural demographics in the city. Counting wages earned by residents and workers in the city, Manhattan alone has a cumulative buying power of over $300B. The city attracts 54M annual tourists, who contribute an additional $39B to the local economy. There is nowhere else in the world with the same concentration of population and wealth.

Some international brands are already recognizing the potential in this current retail real estate market. One such company taking advantage of these trends is The White Company, a British brand selling clothes, home decor and other items mostly in shades of white. With more than 50 stores throughout the United Kingdom, The White Company dipped its toes in American waters with a successful U.S. website and has since leased its first U.S. Flagship on Fifth Avenue in the heart of New York’s Flatiron District. A second location in New Jersey is forthcoming.

Mixed use retail and leisure: What happens next? – White Paper

Another European company who has committed to a U.S.-based brick-and-mortar presence in 2017 is Calzedonia. The Italian chain sells women’s intimates in more than 1,400 stores across the world and this year, decided to open a 5,400-square-foot store in Midtown Manhattan, maintaining a presence on Fifth Avenue between 48th and 49th Streets, close to such well-known tourist destinations as Saks Fifth Avenue, Radio City Music Hall and Rockefeller Center. Calzedonia plans to open 20 stores across the East Coast, with additional locations slated for 2018.

This year also saw the American brick-and-mortar debut of high-end, Paris-based fashion label Sézane. The brand opened its first U.S. boutique on Elizabeth Street, in the fashionable SoHo neighborhood of New York City. Designed to feel like a French apartment, the small shop, which also features a café, was a response to the many New York-based customers asking for the brand to establish a presence in the city, according to Sézane founder Morgane Sezalory.

Opportunities for U.S. expansion exist for more than just apparel companies, as evidenced by the swift growth of Asian QSR concept Wasabi Sushi & Bento. With several outposts throughout the United Kingdom, Wasabi Sushi & Bento prefers central business districts and transit hubs—both criteria they have been able to focus on successfully since opening their first New York City location in 2014. Over the past year, Winick Realty Group has represented them in the opening of four additional Manhattan locations, with plans to open up to 20 restaurants in New York City alone, on top of a planned expansion throughout the United States.

Another internationally-based Asian QSR concept that has done well in the U.S. market has been Wok to Walk, which operates more than 70 restaurants in Europe, Asia, Africa and South America. Wok to Walk has opened three stores throughout heavily-trafficked neighborhoods in Manhattan and has two restaurants slated for the fast-growing New Jersey neighborhoods of Newark and Hoboken as well.

What these retailers all have in common is a willingness to take advantage of the increased retail availabilities and discounted rents, allowing them to showcase their brand to the world and replicate their international success within the United States and, specifically, New York City. We anticipate that this trend will only grow as more and more companies recognize that the time for their American debut is now.

Winick Realty Group will be at MAPIC 2017 – please visit their stand to learn more about opportunities for retail expansion into USA.

![[NEW] MAPIC interview: In conversation with Sostrene Grene CEO Mikkel Grene Sostrene-Grene](https://www.beyondretailindustry.com/wp-content/uploads/2024/03/Inside-Sostrene-Grene-store-5-1-351x185.jpg)

![[NEW] Women in Retail: 24 trailblazers for 2024 Women in retail](https://www.beyondretailindustry.com/wp-content/uploads/2024/03/image-1-351x185.png)